To Senator Hatch: Save the ODTC

Dr. Helen E. Heslop & Dr. Rachel Salzman - December 12, 2017

The retention of the Orphan Drug Tax Credit within the final tax bill is crucially important in providing the incentives necessary for the innovation of gene therapies for rare diseases.

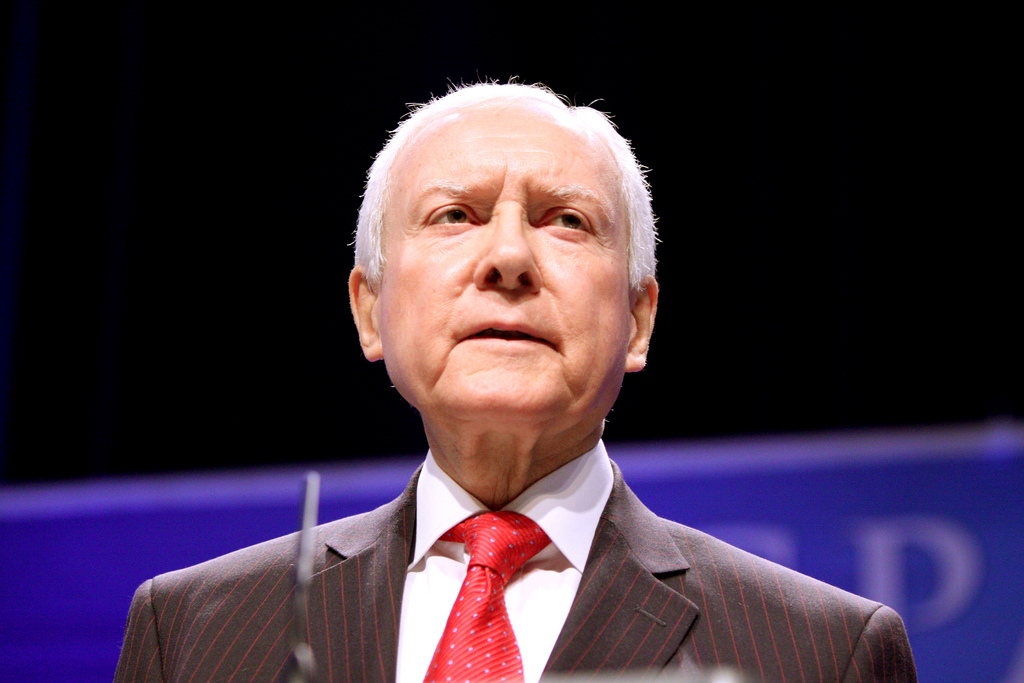

The following letter was sent on December 12, 2017 to Senator Orrin Hatch, chairman of the Senate Finance Committee and a member of the conference committee for reconciliation of the current tax bill proposal, by ASGCT President Dr. Helen Heslop and Dr. Rachel Salzman, chair of the ASGCT Government Relations Committee.

Dear Senator Hatch:

The American Society of Gene & Cell Therapy (ASGCT) is writing to express support for the preservation of the Orphan Drug Tax Credit (ODTC) in the Tax Cuts and Jobs Act. The retention of the ODTC within the final tax bill is crucially important in providing the incentives necessary for the innovation of gene therapies for rare diseases. Gene therapy, now approved for the treatment of certain blood cancers, holds substantial potential to provide vital treatments for rare diseases, which are often caused by genetic mutations.

ASGCT is a nonprofit professional membership organization comprised of nearly 2,500 scientists, physicians, and patient advocates working in academia, industry, and the government. The Society is dedicated to advancing the knowledge, awareness, and education of gene and cell therapies to alleviate human disease.

Two ASGCT members—Matthew Porteus, MD, PhD, who is a member of the Board of Directors, and Katrine Bosley—recently had the opportunity to provide information about gene editing, a type of gene therapy, through a Senate HELP Committee hearing. Reflective of the Committee members’ appreciation of the transformative potential of gene editing, Chairman Alexander remarked at the hearing, “the possibility of the diseases it could treat and the lives that could be improved is remarkable.”

Gene therapy could indeed address significant unmet clinical need, because many rare diseases are serious or life-threatening and few have currently available treatments. In addition, gene therapies may be administered as infrequently as once with durable or potentially curative results.

However, years of research may be necessary to arrive at an effective approach, and the small pool of patients with a particular rare disease available for clinical trial participation may further extend the timeframe to attaining market approval. The scientific and clinical research risks of gene therapy development for rare diseases are therefore high. Such deterrents to innovation of gene therapies for rare diseases must be balanced by incentives that provide the potential for sufficient return of financial investment. Eliminating the orphan drug tax credit would discourage the innovation of gene therapies for rare disease in the U.S. ASGCT agrees with Sen. Kaine’s assertion at the gene editing hearing that the U.S. should be a leader and remain in a leadership position, “so that we don’t run into a position where… we’re chasing away innovation to other locations.”

The Society appreciates your long history of encouraging the innovation of treatment of rare diseases through your sponsorship of the Orphan Drug Act and the OPEN ACT and your service as Senate co-chair for the Rare Disease Congressional Caucus, among other efforts. ASGCT urges you to continue this support by advocating for the preservation of the Orphan Drug Tax Credit in the final version of the Tax Cuts and Jobs Act. Thank you for your consideration of the significance of this issue.

Sincerely,

Helen E. Heslop, MD

President

Rachel Salzman, DVM

Chair–Government Relations Committee

Related Articles